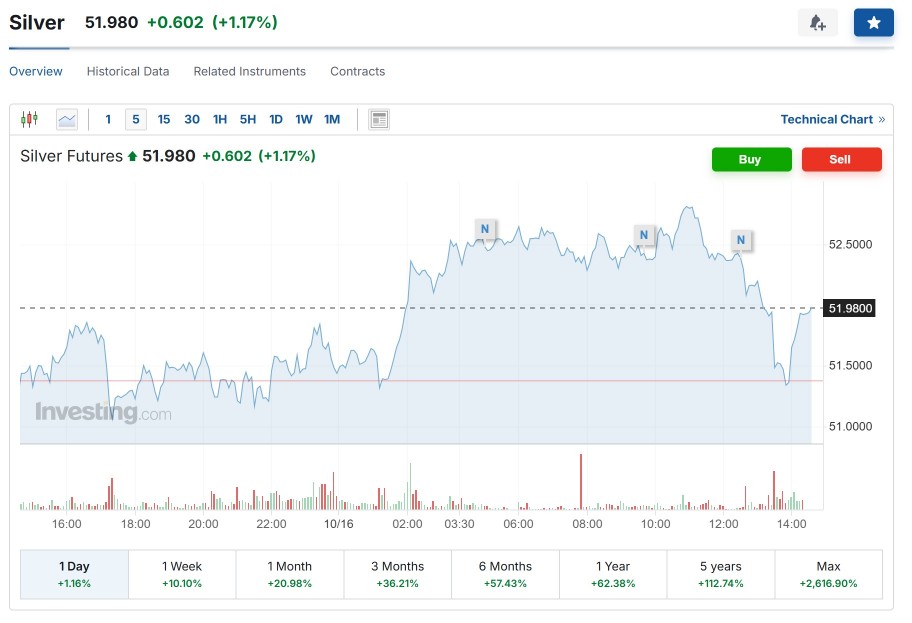

Since 2025, the sustained rise in silver prices has become the focal point of the precious metals market. As of October 16, London spot silver traded at $52.982 per ounce, while Shanghai spot silver (T+D) reached 12,088 yuan per kilogram—marking a year-to-date increase exceeding 20%. This upward trend stems from both expanding global industrial demand and a surge in precious metal investments. For the electrical contact point industry, which relies heavily on silver as a core raw material, these price fluctuations are driving profound transformations across the supply chain.

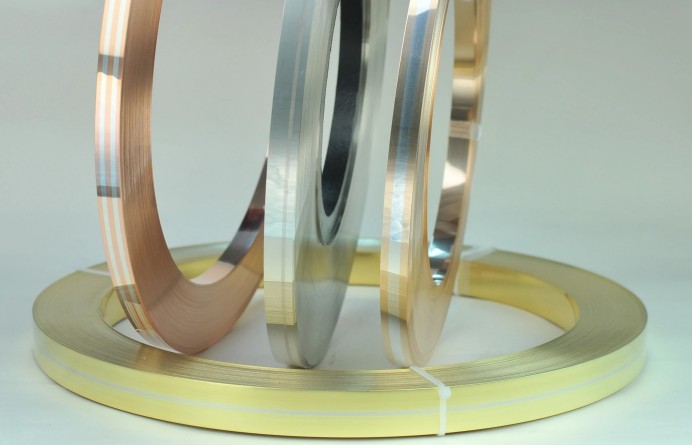

The silver price surge imposes particularly significant cost pressures on the electrical contact point sector. Pure silver contacts account for 35% of the overall electrical contact product market, valued at approximately RMB 2.633 billion in 2024, with silver costs exceeding 60% of the total. For enterprises in industrial clusters like the Yangtze River Delta and Pearl River Delta, every 10% increase in raw material prices compresses gross profit margins by an average of 3-5 percentage points. The industry widely adopts techniques like silver-copper inlay and surface lamination to reduce silver usage while maintaining conductivity.

It's worth noting that price pressure is becoming a driving force for industry upgrading. At the policy level, the "New Materials Industry Development Guidelines" explicitly support the research and development of high-performance electrical contact materials, with national special R&D funding reaching 1.2 billion yuan by 2025. On the technical side, the penetration rate of environmentally friendly cadmium-free contact materials is expected to increase rapidly from 28% in 2024, and the application of composite materials such as silver tin oxide in high-voltage relays is expected to grow at a rate exceeding 15%. Improved recycling systems are also easing cost pressures. By 2025, the recycling price of silver contacts will reach 2,000-4,000 yuan per kilogram, with the recycling price of high-silver-content products approaching that of pure silver.

Looking ahead, driven by supply-demand gaps and policy incentives, silver prices are likely to remain elevated with volatility, while the electrical contact point industry maintains its growth resilience.

Post time: Oct-16-2025